Nigerian Real Estate Market Outlook 2025-2030

Targeting Abuja Luxury Buyers and Real Estate Investors

© February 2025 Bashir Ademola Yusuf / Estate Code Nigeria Ltd / Silat Estates Invest Ltd. All rights reserved. This report is protected by copyright and may not be reproduced, distributed, or transmitted in any form or by any means without the author’s prior written permission.

Executive Summary

Nigeria’s real estate market presents exceptional opportunities for luxury property buyers, strategic investors, and diaspora investors, especially in Abuja. This report offers an in-depth analysis from 2025 to 2030, focusing on ethical practices, sustainable development, and emerging trends to maximize returns and long-term value.

Introduction to the Nigerian Real Estate Market

The Nigerian real estate sector is a vital economic engine that navigates opportunities and challenges amid urbanization and a considerable housing deficit. This report provides actionable insights for luxury buyers, investors, and the Nigerian diaspora.

Market Analysis

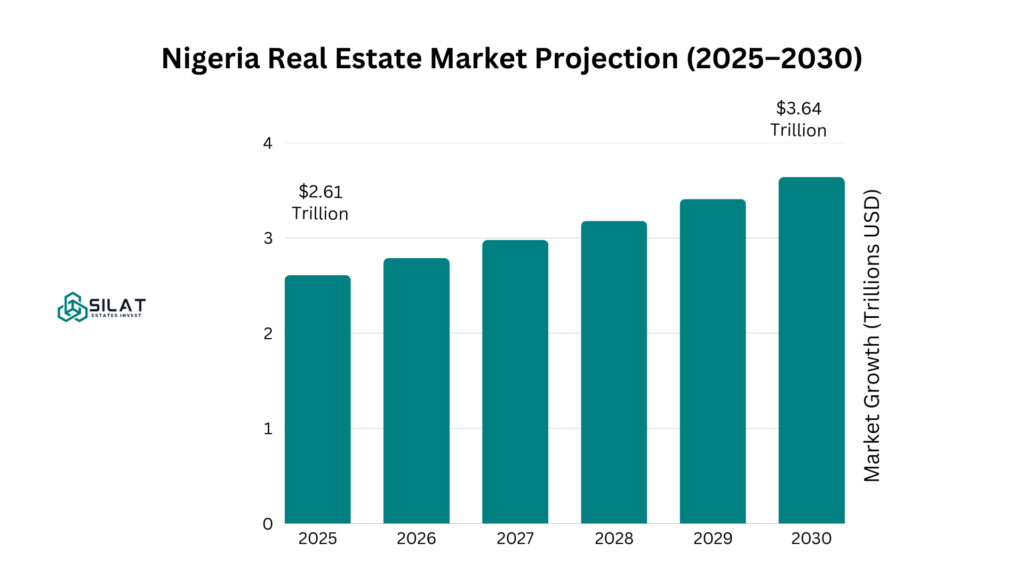

Nigeria Real Estate Market Projections

Market Size and Growth Highlights

2025 Market Size: Estimated at approximately $2.61 trillion.

Segment: Residential Real Estate holds the largest share among the various market segments, with a projected market volume of $2.25 trillion by 2025.

Projected Growth: The market is expected to grow to $3.64 trillion by 2030, at a CAGR of about 6.87%, according to statista.com.

The luxury segment is expected to grow faster, driven by urbanization, government initiatives, and a rising affluent population, particularly in major cities like Lagos and Abuja.

Compared with the global Real Estate Market, the United States is projected to generate the highest value of the market share with a projection of US$136.6tn in 2025.

The sector accounted for 6.06% of real GDP in the fourth quarter of 2024.

Nigeria’s population is growing by 2.5% annually, and urban migration is also increasing, which directly correlates to real estate investment growth.

The housing deficit is around 28 million; about 700,000 new housing units are needed annually to bridge the gap.

Detailed Growth Comparison Chart

This growth trajectory, fueled by increased FDI and government support, presents diverse opportunities for smart investors. Despite current economic challenges, the market is expected to rebound strongly.

Housing Demand Projection from 2025-2030

Due to rapid urbanization and demographic changes, housing demand is projected to grow by approximately 8% annually. Cities like Lagos, Abuja, and Port Harcourt face significant housing pressures from migration trends.

Housing Supply Projection from 2025-2030

Housing supply grows at about 6% annually, constrained by high construction costs but supported by government initiatives like Renewed Hope Cities, delivering over 20 thousand units annually.

Pricing Trends Projection from 2025-2030

Property prices are expected to rise by about 10-12% annually, driven by limited land availability and inflationary pressures affecting construction costs.

Market Segmentation

The Nigerian real estate market is segmented to provide insights relevant to luxury buyers, investors, and the Nigerian diaspora.

By Type

- Luxury Residential Real Estate: This includes high-end apartments, villas, and custom-built homes in prime locations like Maitama and Asokoro in Abuja and Ikoyi and Banana Island in Lagos.

- Commercial Real Estate: This segment encompasses premium office spaces, high-end retail outlets, and mixed-use developments that target affluent clientele in major urban centers.

By Mode

- Exclusive Online Platforms: Digital platforms catering to luxury properties, offering virtual tours and personalized services.

- Private Brokerage Networks: High-end real estate agencies providing bespoke services for clever clients.

By Property Type

- Fully Finished and Smart Homes: Ready-to-move-in properties with smart home technologies, high-end finishes, and premium amenities.

- Custom-Built Homes: Tailored to individual preferences, offering unique designs and luxury features.

Abuja Real Estate Market Projections

As of February 2025, the Abuja real estate market is experiencing significant growth driven by several factors:

Market Growth

- Abuja’s real estate market is expected to grow at a 7-9% CAGR from 2025 to 2030, fueled by government-backed housing initiatives, diaspora investments, and infrastructure upgrades.

Rental Market Stability

- Rents in Abuja are expected to stabilize as new housing developments meet demand. Initiatives like the Renewed Hope Cities project, which will deliver over 3,112 housing units in 2025, will ease rental pressures, according to the Honourable Minister of Housing and Urban Development, Arc. Ahmed Musa Dangiwa.

Emerging Locations for Investment

- Emerging residential areas like Jahi, Katampe Main, Lifecamp, and Wuye are gaining traction due to their proximity to key infrastructure, ongoing development projects and relative affordability compared to the high-end districts.

- High-end districts like Maitama, Asokoro, Guzape, and Katampe Extension remain prime locations for luxury buyers due to their exclusivity and strong appreciation potential.

Infrastructure Development

- Projects like the Abuja Light Rail expansion and road network upgrades will enhance connectivity between emerging districts and central business areas. According to Nairametrics.com, about 11 months ago, the Honourable Minister for the Federal Capital Territory (FCT), Mr. Nyesom Wike, has announced that the Abuja Rail Mass Transit (ART) project is on the verge of completion, with 97% of the work already done.

Rental Market Stability in Abuja

As of February 2025, the rental market in Abuja is experiencing significant growth driven by several factors:

High Demand for Rental Properties:

- Abuja’s population has surged past 4 million, growing rapidly each year. As a result, the demand for housing is skyrocketing as civil servants, business professionals, and families seek quality accommodations in secure and accessible locations.

- The influx of new residents puts pressure on both the rental and sales markets, leading to increased competition among landlords.

Increased Supply from Construction Boom:

- Abuja experienced a construction boom in 2023 and 2024, increasing the housing supply. Government-backed projects and private developments added new estates and apartment complexes to the market.

- Despite this oversupply, rents remain high due to sustained demand and limited availability of affordable units.

Projected Rental Yields:

Rental yields in central Abuja are expected to rise as demand remains strong. The luxury segment may see slower growth due to increased supply but is still projected to maintain attractive yields.

Experts predict that multifamily rents will see a steady annual increase of approximately 3.1% over the next five years, reflecting ongoing high demand. (theafricanvestor.com)

Future Outlook:

The rental market is anticipated to remain competitive throughout 2025, with opportunities for investors as rising rents could offer attractive returns.

As Abuja continues to expand, the pressure on the housing market is unlikely to ease soon, making it essential for potential buyers and investors to stay informed about local dynamics.

Key Trends Shaping the Market

Affordable Housing vs. Luxury Development:

- Affordable Housing vs. Luxury Development: Nigeria faces a housing deficit of approximately 28 million units, according to the Honourable Minister of Housing and Urban Development, Arc. Ahmed Musa Dangiwa. This drives demand for affordable housing solutions, while the luxury segment sees increased activity due to a growing affluent population.

Rise of Smart Homes:

- Smart technology adoption is on the rise in urban areas like Abuja and Lagos, with features such as energy-efficient designs becoming key selling points.

Technology Integration:

- Platforms like Nigeria Property Centre and Everything Property Mobile App, recently launched by realtor colleague Mr Ayo, enhance market accessibility through digital listings and transactions. Other innovations include virtual tours, data analytics, blockchain for secure transactions, and smart home integrations.

Investment in Infrastructure:

- Ongoing infrastructure projects, like the completion of abandoned roads and the initiation of new ones, have significantly improved connectivity and attracted real estate investments. Notable commercial developments like the Karmo District Market, built by Rural Homes Ltd in partnership with Abuja Investment Company Ltd, have created significant economic opportunities with over 2,000 shops and other commercial spaces. According to Alh Musa Aliyu Dangoggo, Chairman of Rural Homes, the project has generated over 5,000 jobs during construction and is expected to create an additional 10,000 jobs when fully operational. He emphasized their mission to create modern marketplaces that meet business, investor and community needs.

Sustainable Building Practices:

- Green building practices attract socially conscious investors with eco-friendly materials and renewable energy sources. This trend shapes the preferences of affluent buyers and investors, enhancing property value.

Opportunities & Challenges

Drivers and Restraints

Drivers

- Urbanization: According to the United Nations, Nigeria’s urban population is projected to reach 65% by 2050, significantly increasing housing demand, particularly in major cities like Abuja and Lagos. (Source: UN Population Division).

- Government Initiatives: The National Housing Fund (NHF), Family Homes and other government initiatives have been instrumental in providing affordable housing solutions. According to the Honourable Minister of Housing and Urban Development, Arc. Ahmed Musa Dangiwa, the Renewed Hope Cities and Estates Programme, currently has 14 active construction sites nationwide, with a total of 10,112 housing units, while the FCT has the highest share at 3,112 units.

- Foreign Direct Investment (FDI): The country has always enjoyed an increase in the volume of the FDI to boost its infrastructure development in FCT and across other regions, and this has positively impacted the real estate market.

- Rising Affluent Population: The growing class of high-net-worth individuals drives demand for luxury properties, particularly in major cities like Lagos and Abuja.

- Diaspora Investments: Nigerians in the diaspora are increasingly investing in real estate back home, which has significantly impacted the increasing rate of luxury home demand. According to the Nigerians in Diaspora Organisation Europe (NIDOE), Nigerians abroad send over $20 billion back home annually.

Restraints

- High Construction Costs: The rising prices of building materials have been attributed to inflation and supply chain disruptions.

- Land Acquisition Challenges: Bureaucratic hurdles often delay project timelines, making it difficult for developers to secure land for new projects.

- Infrastructural Deficits: Inadequate infrastructure in some areas limits development and increases the cost of home delivery as the infrastructure development is added to the final unit cost.

- Regulatory Uncertainty: Inconsistent policies and regulatory hurdles deter investments and create uncertainty. “According to experts, the incessant demolition of houses in Abuja and Lagos discouraged real estate investment in Nigeria.

- Exchange Rate: High cost and unstable exchange rates are major challenges in the industry, especially in the luxury segment, where the majority of the finishing inputs are imported.

Key Investment Locations

Location

Description

Key Drivers

Target Market

Maitama

High-end residential area; preferred by government officials and expatriates.

Proximity to key government institutions, high-quality infrastructure, secure environment.

Luxury buyers, investors

Asokoro

Exclusive neighbourhood with luxurious homes; attracts high-net-worth individuals.

Top-tier amenities, serene environment, high property values.

Luxury buyers, investors

Katampe Extension

High-end residential districts are characterized by modern luxury apartments and houses.

Strategic location, well-planned layout, and high-quality infrastructure.

High-net-worth individuals

Guzape

Emerging high-end area; rapid development and infrastructure upgrades.

Modern infrastructure, potential for high property appreciation, strategic location.

Investors, high-end renters

Wuse II

A prime commercial hub; home to businesses and retail outlets.

Thriving commercial activity, well-connected transportation, access to amenities.

Commercial investors

Jahi

An emerging residential area that offers more affordable housing options compared to the more central districts of Abuja.

New infrastructure developments, affordable land prices, and a growing population base.

Investors, middle-income earners

Katampe Main

A rapidly developing district with a mix of residential and commercial properties.

Central location, ongoing construction activities, and proximity to major roads and amenities.

Mixed-income earners, commercial entities

Lifecamp

Well-established residential district known for its serene environment and proximity to key government and commercial areas.

A mix of housing options, good road connectivity, and access to amenities.

High/Middle-income earners

Wuye

A developing district with a mix of residential and commercial properties, offering investment opportunities in the mid-range market.

Strategic location, ongoing construction activities, and good road network.

High/Middle-income earners

At Estate Code Nigeria Ltd and Silat Estates Invest Ltd, we prioritize these emerging hubs, which enables us to align our services with the city’s vibrant growth.

Investment Strategies and Recommendations

Investment Strategies

Investment Strategies For Luxury Buyers

Focus: High-end properties in Maitama, Asokoro, Guzape, Wuse II and Katampe Extension.

Embrace Sustainable and Smart Home Technologies: Seek properties that incorporate eco-friendly designs, energy-efficient systems, and smart home features.

Engage with Reputable Developers & Agents: Work with established developers and agents who have a proven track record in the luxury market and a strong reputation for ethical practices.

Personalize Your Investment: Consider custom-built homes that meet specific lifestyle needs with unique designs and premium services.

Prioritize Properties with Strong Resale Value: Evaluate potential properties based on historical appreciation rates.

Investment Strategies For Real Estate Investors

Focus on Emerging High-Growth Areas: Identify areas like Guzape II, Jahi, Katampe Main or Lifecamp in Abuja where infrastructure projects are expected to drive property values. Strategic commercial hubs such as Wuse II are also good investment considerations.

Diversify Your Portfolio: Balance investments across different property types (e.g., residential, commercial) to mitigate risk.

Leverage PropTech for Efficiency: Utilize digital platforms for property listings and management. This will improve efficiency and reduce costs.

Seek Sustainable and Ethical Investment Opportunities: Prioritize projects that align with ethical practices and sustainability to attract socially conscious tenants. ESG factors are increasingly important to investors.

Consider: Properties with high rental yields and strong potential for capital appreciation.

Prioritize: Sustainable developments and ethical investment principles. as well as emerging areas like Jahi, Katampe Main, Lifecamp, and Wuye.

Collaborate with Local Experts: Partner with reputable firms that possess in-depth knowledge of the local market.

Explore No-Interest Funding Access: Explore no-interest loans through systems like lease-to-own, which will enhance flexibility and reduce the board of compounded interest

Investment Strategies For Nigerian Diaspora and Foreign Investors

Invest in Prime Locations: Look to prime locations with high rental yields and property appreciation rates.

Consider Ready-to-Move-In Properties: Opt for fully finished properties that offer convenience and immediate returns.

Use Reputable Platforms: Utilize trusted online platforms to search for verified listings and engage with reputable agents.

Work with Local Experts: Partner with real estate firms that specialize in assisting diaspora and foreign investors.

Rental Yield: Look at properties with good rental potential, those with strong ROI and great property appreciation rates.

Prioritize the Location: Be sure the location is safe and double-check the builders’ reputation.

Understanding Local Regulations: It’s crucial to consult with trusted local real estate firms and legal experts to navigate the regulatory landscape, particularly regarding land ownership and property rights.

Leveraging technology for Remote Property Management: The proptech solutions have become the game-changers with features like remote rent collection, tenant screening, and property maintenance monitoring. This will allow diaspora investors to manage their properties effectively from afar.

Recommendations

Recommendations for Developers

Embrace Transparency: Developers should prioritize open communication about project timelines, costs, and potential challenges to build trust with clients.

Quality Craftsmanship: Focus on delivering high-quality construction that meets or exceeds industry standards.

Client Engagement: Involve clients in the decision-making process to ensure their needs and preferences are met.

Invest in Sustainable Practices: Incorporate eco-friendly designs into new developments to attract environmentally conscious buyers.

Recommendations for Policymakers

Implement Transparent Policies: Develop regulations that promote ethical practices and protect both buyers and sellers.

Streamline Regulatory Processes: Simplify procedures to facilitate smoother transactions and reduce bureaucratic delays.

Incentivize Ethical Practices: Offer tax breaks or subsidies for developers who adhere to ethical standards and sustainable practices.

Implement No-Interest Funding Models: No-interest loans through government-backed initiatives can be the right way to ease the funding challenges in the real estate industry.

Why Ethical Real Estate Practices?

In today’s dynamic real estate landscape, ethical practices are indispensable for building trust and fostering a resilient market. Transparency and sustainability are key to creating trustworthy relationships and sustainable investments.

At Estate Code Nigeria Ltd and Silat Estates Invest Ltd, we prioritize ethical standards such as transparency and fair housing practices. As ESV Douglas Omachugo emphasizes, “Ethical practices are the backbone of a resilient real estate market” (Source: ThisDayLive).

Ethical practices not only enhance stakeholder confidence but also contribute to economic growth by attracting foreign direct investment and promoting industry sustainability. By upholding these standards, we ensure professionalism, accountability, and a positive reputation for the industry.

As we navigate the ever-evolving landscape of Nigerian real estate, embracing ethical practices and strategic insights is paramount. Abuja, with its unique opportunities and burgeoning potential, stands as a beacon for investors and stakeholders who are committed to building a sustainable and prosperous future. Let’s collaborate to shape a real estate sector that embodies integrity and delivers lasting value.

About the Author: Mallam Bashir Ademoa Yusuf is a passionate advocate for ethical and sustainable real estate practices in Nigeria. As the driving force behind Estate Code Nigeria Ltd and Silat Estates Invest Ltd, Bashir champions transparency, integrity, and community engagement in every project. He has a knack for identifying key market trends and connecting investors with prime opportunities, particularly in Abuja’s dynamic real estate landscape.

Disclaimer and Call to Action

This report is provided for informational purposes and is based on data available up to February 2025. While every effort has been made to ensure accuracy, the author disclaims any liability for losses arising from reliance on this report. For personalized guidance on real estate investments in Abuja, feel free to reach out to me directly. I am committed to helping you navigate the market effectively.

Work With Me To Achieve Your Real Estate Dream

If you have any questions about identifying profitable real estate opportunities or need personalized guidance on your investment journey, feel free to reach out to me directly. Let’s connect and explore how you can maximize your real estate investments!